The pricing strategy is a key part of any business plan and is crucial for any business.

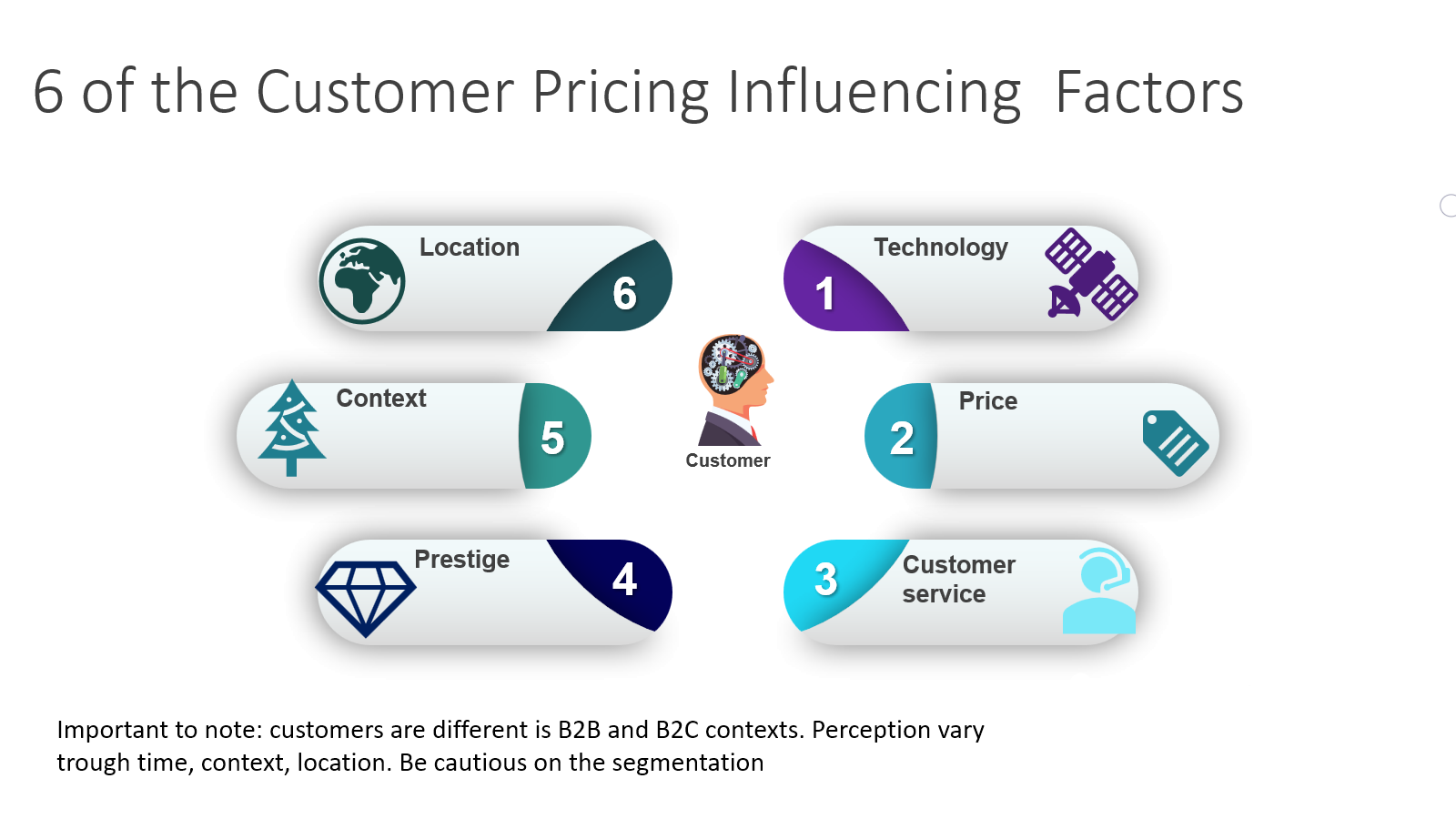

Setting prices is not an easy task, because businesses want to maximize their resources and efficiency and simultaneously to provide high value for their clients. Even if establishing a pricing strategy may be overwhelming, there are numerous pricing strategies and pricing models that can help you. The purpose is to set the right price, for the right customers, at the right time, within the right context.

This guide aims to be a solid starting point for beginners looking to have a better idea on how to put in place a pricing strategy and which are the most used models.

Price is more than the amount of money one has to pay for an item, price is communication and also a signal. For example, luxury brands like Chanel set a certain level of price to provide a signal concerning the top quality and uniqueness of their products.

While setting prices a company has to identify the right range of price to appeal to their clientele and simultaneously hit their business goals.

In a top of factors that drive purchase decisions, price and promotions rank in the first place.

While evaluating a business the pricing ranks again in top. According to Warren Buffet “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

Source: AzQuotes

Thus, price is a key element for all implied parties and businesses have to find the equilibrium that please everyone. That’s why it is vital for companies to have a very clear understanding of what is a pricing strategy, how to establish a coherent one and what models they can use to manage their businesses.

What is pricing strategy?

The pricing strategy is the assembly of elements and methods that a business uses to set the price for their products or services in a certain interval of time. It takes into consideration a wide variety of factors like:

- Market conditions for each segment

- Competition and their pricing strategies

- Product/service characteristics

- Product’s cost (includes input costs, production, marketing and distribution costs, indirect costs)

- Profit margins

- The price that consumers are willing to pay for the respective product or service

The pricing strategies employed by a company modify along the time with the product/service lifecycle, with the evolution of the business itself, if external factors imply (e.g. Covid pandemic or legislation updates), etc.

Each company has its own way of setting prices.

It’s worth noting that pricing strategies are not always primarily related to profit margins. There are times when a company counts on very low prices (dumping prices) to gain market share or keeps the prices low to prevent the entrance of new competitors in their niche.

No matter how a company chooses to establish the prices of their products or services, it should always bear in mind that it has to cover its costs. At least. Or it risks disappearing.

Anyway, businesses work for profit. And even if there are periods when they use discounted prices and promotions, their main purpose remains the profit.

In general, the ultimate scope of a pricing strategy from a business’ point of view is to help maximize revenues and profits.

When establishing pricing strategies in economics, a business should also take into consideration the price elasticity of demand for their product/service. This is an important principle that governs the price.

The price elasticity of demand measures the sensitivity of customers’ demand to the product’s price modification.

Products for which a price increase will not impact or will impact insignificantly the demand are called inelastic. (basic foods and utilities, in a certain measure, are such products).

Products for which a price increase will translate into a demand decrease are called elastic. (snacks and popular drinks are such products).

Use the following formula to calculate a product’s price elasticity:

% Quantity Modification ÷ % Price Modification = Price Elasticity of Demand

The price elasticity helps determine if your product is elastic or inelastic to price fluctuations. And in consequence you will know how to adjust your pricing strategies.

How to establish a pricing strategy

Choosing a price strategy relies on many elements like overall business strategy, marketing strategy, market conditions, economic conditions, customer insights and data, metrics, product costs, etc.

There are many pricing strategies for businesses currently available and used. Most often a company uses a mix of various pricing strategies for a certain period. And this mix evolves in time with the market conditions.

To choose correctly your pricing strategy follow these steps:

Determine Your Buyer Personas (Customer Avatar/ Ideal Buyer)

The first step in any business strategy is to know in detail who is the client that will buy your product/service. And the pricing strategy is no exception.

You have to research and define your personas by answering questions like:

- Who is this client?

- Which are his pain points that your product/service solves?

- What is the most important value proposition for him?

- Which are the most important features of the product that he is interested in? The least?

- What is the lifetime value (estimated) for this client?

- This client uses which main marketing channels ?

- What is the price level at which the client is interested to buy the product?

- Who else has to approve the purchase (if the case)?

- What is the estimated cost of acquisition for this customer?

For B2C businesses, all your marketing efforts and strategy are based on these buyer personas you should take the time and study them. Use surveys, interviews, AI (artificial intelligence) tools to gather the information you need. For B2B businesses, other factors should also be considered: the economic context of the company, the structure of their market, their decision making process, etc.

For B2C, identifying the buyer personas is a fundamental step. For B2B the context, market and the decision making process are the fundamental steps.

B2C – Identify Which Features Appeal to Each Persona

The buyer personas are the starting point for building your pricing strategy. After that you need to identify which features of your product are of primary interest for which persona.

The main purpose is to have a hook, an entry point for each persona and then attract them into a sales funnel via upgrades. (For example: you attract the buyer persona with a free lead magnet, after that they purchase a low price product, next they buy a more expensive product, etc).

Establishing what is your product’s feature that a buyer persona appreciates most is not that difficult. You have to survey them and ask the right questions. You have to formulate your questions in such a manner that the respondents are forced to make a decision, decide on the set of features and quantify its importance for them.

B2B

Establishing Business to Business(B2B) pricing differs significantly from Business to Customer (B2C) pricing. There are many aspects that are different, but here are the most important:

- The decision making integrates a rationale that fits a business and that’s the profit

- The decision for buying takes very often a longer time than in the consumer case

- Historical data can be used to compare similar services and products

- Purchasing techniques used by businesses are often a significant hurdle

Metrics and Value – Identify the Proper Metric

The metric is an important factor of your pricing strategy, it’s the measure according to which you charge (charge per hour, charge per month, charge per user, charge per project, etc.). You should align your revenue model with your client acquisition model.

A value metric has the following main characteristics:

- Respond to your client’s needs

- Evolve with your client’s needs

- Be obvious and easy to understand

Some examples of value metrics:

- If you are an e-commerce selling personalized t-shirts your metric will be “per t-shirt” and your business increases as your clients buy more t-shirts

- If you are a payment processor like PayPal or Skrill the metric may be the income generated

- If you are an app like – HootSuite (helps you manage your social media activity) you will charge a monthly fee and your value metric will be “per month”.

The metrics are the basis on which are built the monthly recurring revenues projections.

Set the Price for Your Product/Service

It took a long way until you actually arrived at the point where you set the price for your service/product. To do this you need, again, to collect data concerning the price sensitivity. Just ask your clients.

For each of us “value” has a different meaning and most often is not a single element, is a sum of factors. And quite often a customer is not able to offer a direct and straight answer when asked “how do you value this product?”. But, in the collective perception, a cake is cheaper than a car and these two are much cheaper than an apartment.

To obtain the data you need from your clients concerning your product ask questions like:

- Which is the maximum price you will pay for X product?

- Which is the price level at which you consider X product so expensive that you will never buy it?

- At what price would you consider X product a great deal?

- At what price would you consider X product too cheap to be a qualitative one?

Obtaining clear answers to such questions will offer a clear overview of your customers’ perception about your product’s price.

Remember pricing is an evolving process that needs continuous survey and tweak. Adjust your pricing strategy upon circumstances, keep what brings results, remove what doesn’t and don’t leave money on the table.

Setting prices can be a daunting operation as it includes a plethora of tasks and in case of large companies, multiple teams or workstreams, such as:

- Value Proposition

- Pricing Strategy

- Pricing Tactics

- Pricing Analysis

- Pricing Operations

- Product Management

- Customer Segmentation

- Discounts

- Promotions

- Pricing Tools

- Data Management

- Pricing software

- Pricing Admin

- Profit and Loss

As already said above there are numerous pricing strategies and you can use a mix of them at a certain moment.

The major pricing strategies are popular depending on the maturity of the company, the industry and whether it is a B2B or B2C:

- Value Based Pricing Strategy

- Competition Based Pricing Strategy

- Cost-Plus Pricing Strategy

- Skimming Pricing Strategy

- Penetration Pricing Strategy

Other pricing strategies:

- Subscription Pricing

- Freemium Pricing

- Dynamic Pricing

- High-Low Pricing

- Economy Pricing

- Promotional Pricing

- Psychological Pricing

- Premium Pricing

- Bundle Pricing

- Geographic Pricing

- Hourly Pricing

- Captive Product Pricing

- Tender Rounds Pricing

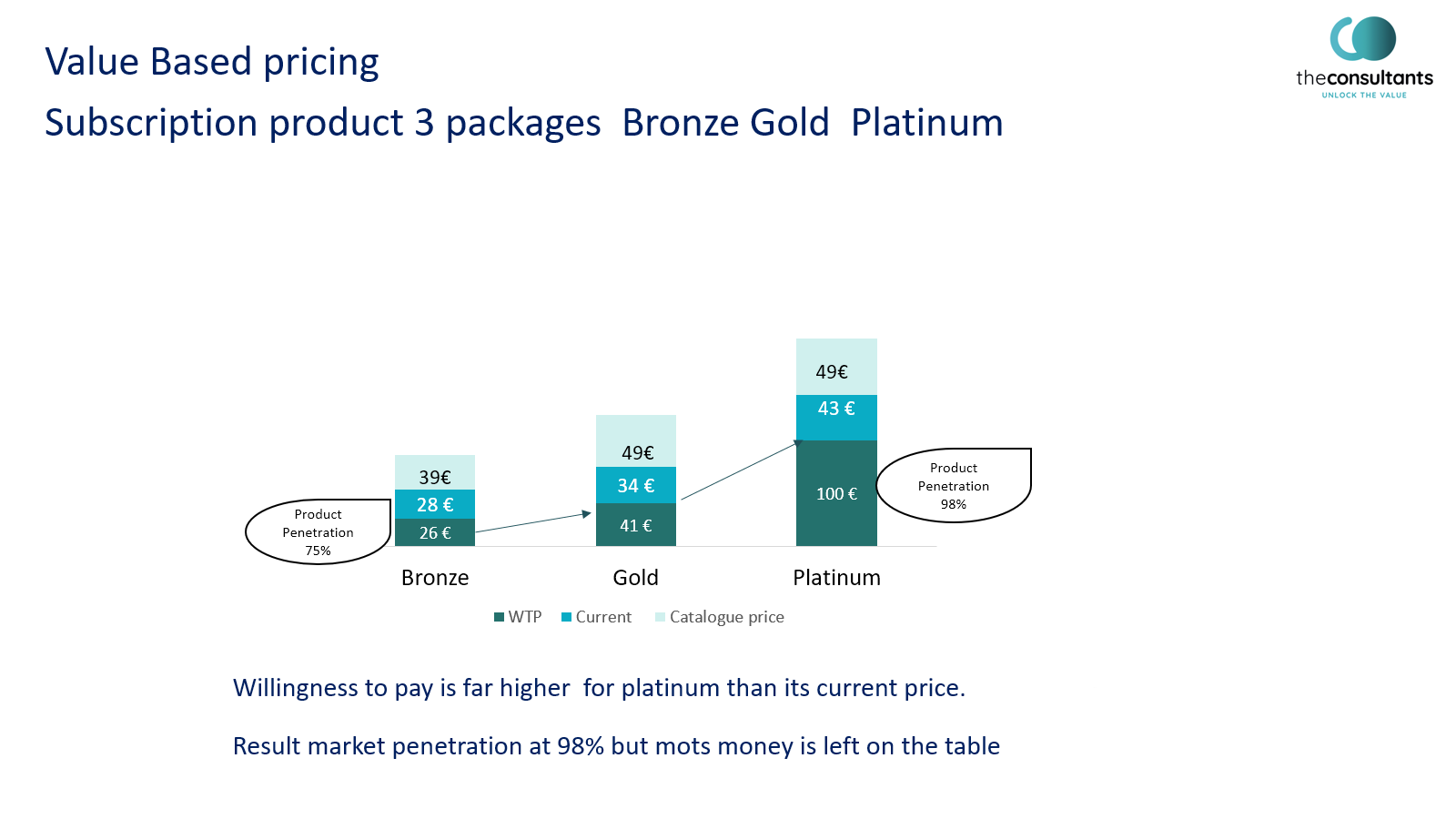

Value-Based Pricing Strategy

What is value-based pricing strategy?

Value based pricing takes into consideration the customers and what they are willing to pay for a product/service. It is heavily based on qualitative and quantitative research.

This methodology is customer centric, as customers are only interested in the value they receive in exchange for their money and not in the costs of producing a product or service.

Customers evaluate the value of a product in function of how well it responds to their needs and desires. Thus, how can you as an entrepreneur determine the value based price?

Here is the process:

- Ask your customers how much they would pay for your products and services

- Identify what differentiate your product

- Assign total value for the differentiators or per differentiators

- Reality check, make sure that this results in a price that includes a profit

- Convince clients that your price is acceptable.

Businesses adopt the value based pricing strategy particularly when they have a strong value proposition.

Pros:

- Considered by some as one of the best pricing strategies

- This approach provides accurate data and allows profit maximization

- Is the foundation of developing better products

- It might increase customers loyalty

- May support customers prioritization for other business areas like service or marketing

- If properly used increases the profitability of your business

- Is a reliable strategy for customer oriented marketing

Cons:

- It is a time and resources consuming process

- Requires continuous gathering data

- Requires that you understand your market

- Involves the creation of evolving prices as customers preferences change

Who uses it?

All businesses that are capable of sustaining such a pricing strategy.

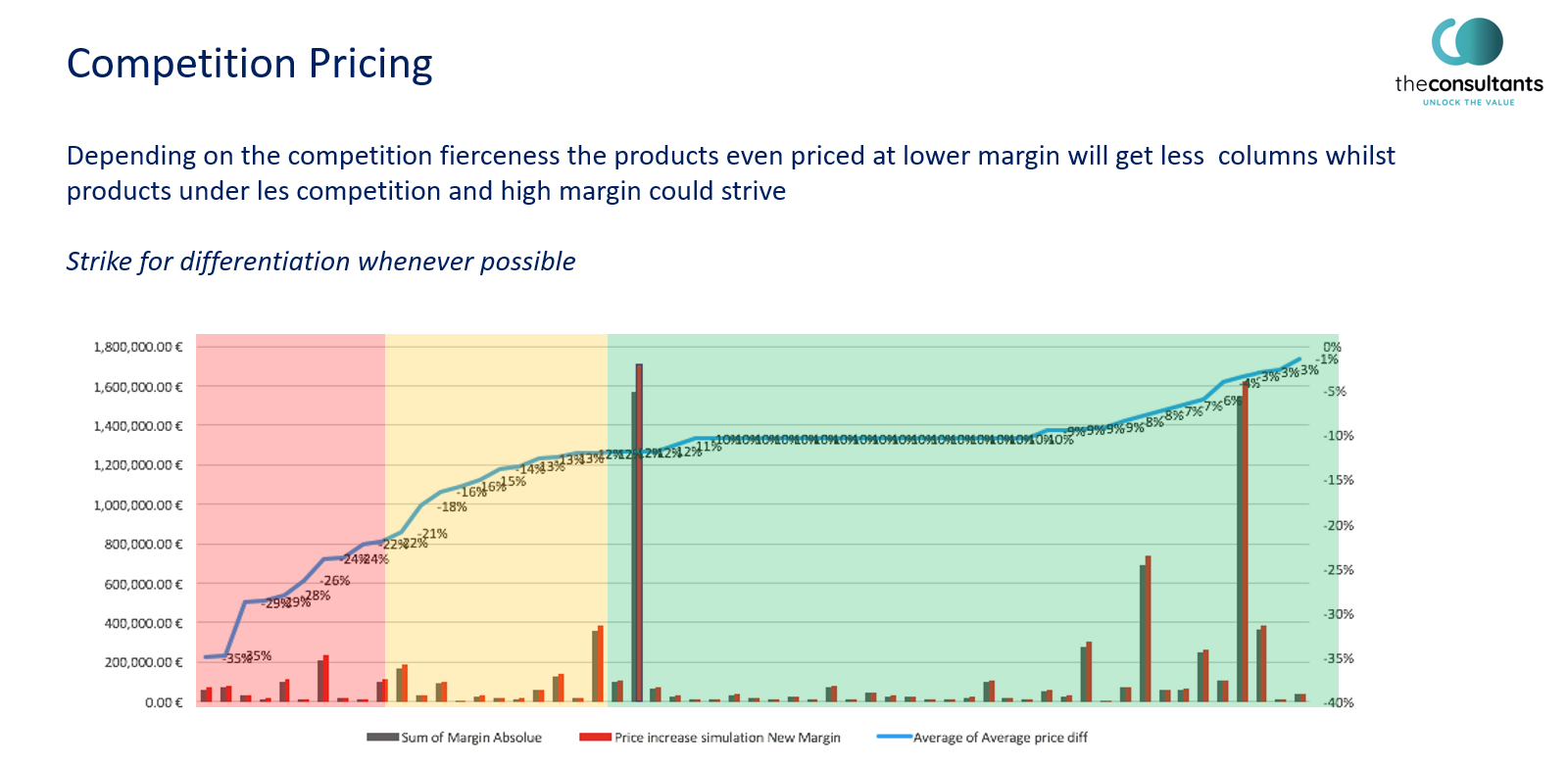

Competition-Based Pricing Strategy

Alternative name: competitor-based pricing, competitive pricing

What is competition-based pricing strategy?

It is a pricing strategy based mainly on the rates practiced by competitors. Often, although this is not the right way to do it, the prices are set within the market price range, slightly above or slightly below this range.

Pros:

- Rather easy to set up in many cases

- Is a manner to remain “competitive”

- It spares you some work as you copy others (assuming they did the research work and they know what they are doing)

Cons:

- You can do it all wrong without realizing it

- Leaves a lot of money on the table

- Does not consider the customers

- Does not consider the cost of the product

- Misses important opportunities as the company does not assess the true provided value

- If the compared products are not congruent many supplementary variables are skipped

Who uses it?

Businesses in highly competitive and saturated markets where slight price differences are perceived by the companies to cause loss of volumes.

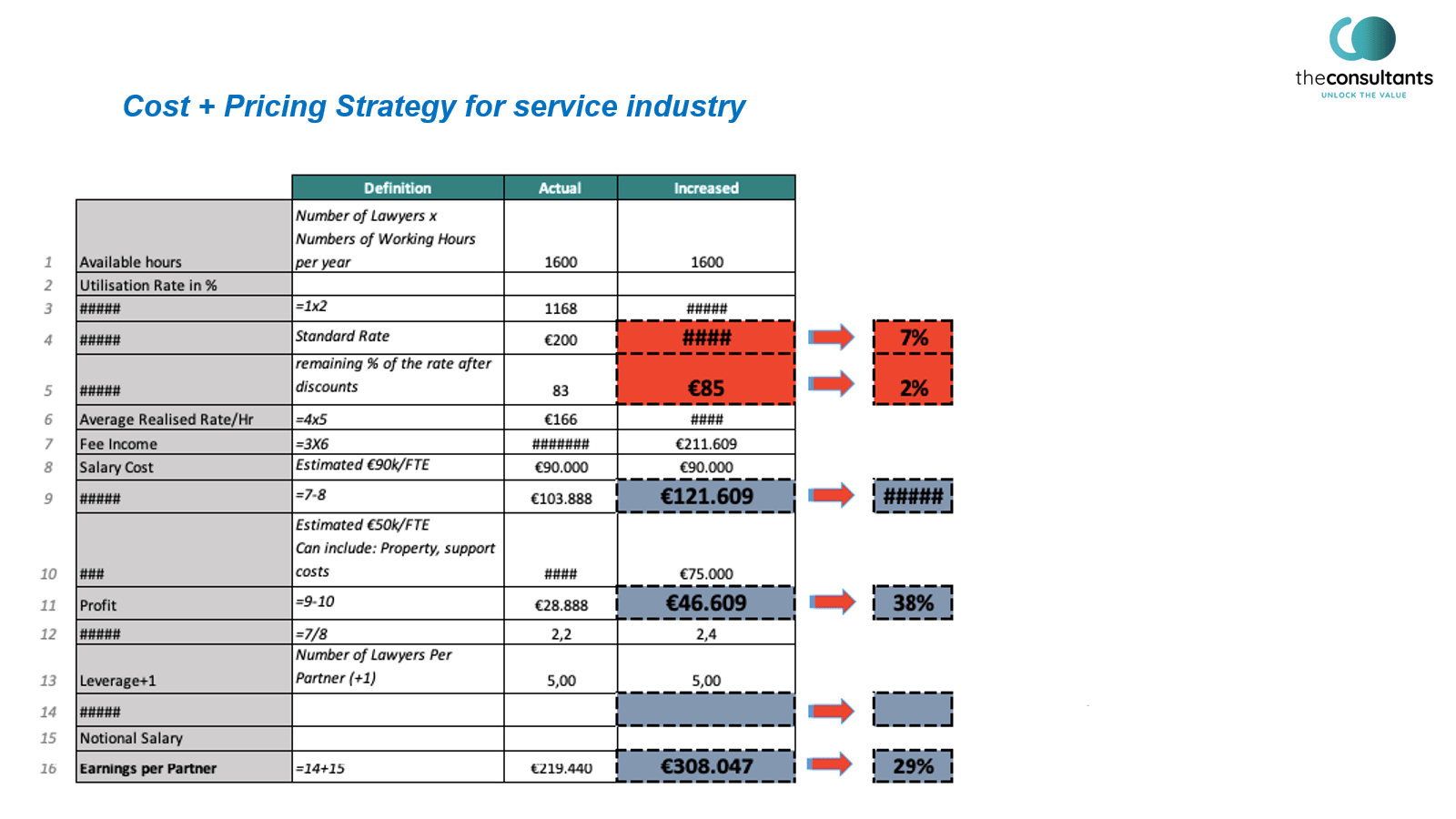

Cost-Plus Pricing Strategy

Alternative name: markup pricing

What is cost-plus pricing strategy?

It is one of the simplest, oldest and most used pricing strategies. It focuses entirely on the cost of producing a product or service and adds up the profit the company wants to obtain – “the mark up”.

Pros:

- It is very simple to apply, needs just a little time and very few resources

- Helps when there is not enough information to use other strategies

Cons:

- Most often is highly inefficient

- Limited possibilities

- Involves little or no market research and no analytics use

- Does not consider consumer demand

- Does not consider competitors’ strategies

Who uses it?

It is highly preferred by starters designing new products and retailers selling physical products.

Skimming Pricing Strategy

What is skimming pricing strategy?

Put in place to help companies monetize products and services while in their early stages of the life cycle, skimming pricing strategy profits on the competitive advantage. Practically, the company charges the highest price when it launches a new product and the price will decrease in time as new competitors appear and the competitive advantage vanishes. Price skimming is among the best pricing strategies for new products, particularly if your product is an innovative one.

Often used by electronics companies as the industry is characterized by new products releases, supported by active marketing campaigns several times a year.

The difference between skimming pricing strategy and high low pricing is that within the skimming pricing the price decreases overtime.

Pros:

- Maximizes profits on the high price paid by early adopters

- Creates a sense of exclusivity and top-notch quality when launching the new product

- Delivers higher return on investments

- Helps recover costs after the product is not a novelty anymore

- Creates and maintains brand awareness

Cons:

- Requires several structural repricing exercises for the same products

- Attracts quickly new competitors

- Creates deception for customers that bought at the initial high price (the ones that you should not upset!)

- It’s not the best fit for crowded markets

Who uses it?

Innovative niches that develop a significant competitive advantage. Technology based products are such examples: laptops, smartphones, 4K TVs, video game consoles, etc.

Penetration Pricing Strategy

Alternative name: pricing to gain market share

What is penetration pricing strategy?

The counterpart of the skimming pricing is the penetration pricing. This implies practicing very low prices for a certain product when entering the market, with the purpose of gaining market share and attracting attention.

Penetration pricing is a short term strategy as in the long run it is not sustainable.

By using such a strategy, the company attracts new clients and hopes they will still remain clients in the future, when the prices will increase.

Penetration pricing strategy brings good results for mass market products, with a price elastic demand and where there is no major difference between competing products.

Pros:

- Can increase brand awareness

- In the long term may create a differentiating factor as a “bottom price”

- Attracts customers from competitors

- Eventually, gets some competitors out of the market (be careful, this can’t be intentional!)

- If the company can benefit from economies of scale it could generate it due to high turnovers

Cons:

- Creates a lower value perception, that will be very difficult to change or exit

- May translate into initial reduction of profits or even losses

- Customers will expect low prices all the time

- Low customer loyalty – reduced prices attract bargain hunters primarily

- May lead to a price war among competitors decreasing the overall niche profitability

Who uses it?

New product launches, start-ups who want to enter competitive markets and create a client base in that niche.

Subscription Pricing Strategy

What is a subscription pricing strategy?

It is a business model based on subscription that is paid to get access to a service or a product. Nowadays this is a very common model. It is a particularly useful approach in industries where clients use the service or product in a continuous manner.

The subscription pricing strategy should take into consideration and find the balance between the preferences and needs of the customers and the company’s budget.

Pros:

- Assures recurrent and predictable revenues from clients that have already subscribed

- Customers consider this model convenient as price and economy of time

- Subscription renewal can be automatically activated

- Forces the business to continuously improve their product/ service and add value

- Allows upselling, cross selling and personalized marketing

- Diminishes the customer acquisition costs

Cons:

- Sometimes paying for subscription may be more expensive than if you pay for the product once

- Increases dependence of a provider (which for businesses might not be an advantage)

- Gathers sensitive data and rises privacy problems

Who uses it?

Initially created for newspapers and magazines, today is used also by mobile phone companies, club memberships, cable and television providers, software providers, journals and online publications, etc. Netflix, Pandora, Spotify, Adobe use this pricing model.

Freemium Pricing Strategy

What is freemium pricing strategy?

It’s a pricing strategy that implies a basic version of the product/service that is offered for free or a period of free trial, in the purpose of attracting the client to pay for the premium version. The name of the strategy is a blend of the words “free” and “premium”.

Pros:

- Builds a non constraint relation with the client before the purchase

- Generates higher traffic

Cons:

- It is not a real context test

- Gives away the created value

- If clients do not correctly appreciate the value of the upgrade you will end up with less revenues

- The business must have extremely low marginal costs for new free users

Who uses it?

It is commonly used nowadays by software companies that offer a large variety of apps. Most of them offer a trial of a couple of weeks or a basic free version of the product.

Dynamic Pricing Strategy

Alternative name: demand pricing, surge pricing, time-based pricing

What is dynamic pricing strategy?

Dynamic pricing is a flexible strategy which uses prices that are frequently and automatically modified based on various criteria like the demand, market conditions, time, location, etc. Practically that means selling the same product/service at different prices to different customers. Most often the dynamic pricing strategy uses algorithms to shift prices to match what clients are willing to pay at the moment they purchase.

Pros:

- Provides the opportunity to take advantage of short-term opportunities

- Enables to recover and adapt fast in front of market events

- Quicker sales with improved profits

- Improved flexibility and trend understanding

- Improved upsell conversion rates

Cons:

- Requires a certain level of expertise

- Tracking technology needs large amounts of data and needs to improve as it can display different prices to the same customer at different moments in time (like showing different price for a service in the same day)

Who uses it?

Airlines, e-commerce companies, hotels, utility companies. Dynamic pricing is applied automatically via algorithms that take into consideration a series of elements like demand, competitor prices, location, customer behaviour, etc.

High-Low Pricing Strategy

Alternative name: discount pricing strategy, hi-low pricing

What is high-low pricing strategy?

It’s a pricing strategy that initially uses high prices for products and subsequently lowers the prices when the product is not a novelty anymore or when its relevance decreases. Examples of high low pricing are the discounts, clearance and seasonal sales. High-low pricing strategy relies heavily on sales promotions to sustain revenue.

Pros:

- It is very popular among clients who love discounts and rebates. Black Friday is such an example

- It creates a sense of urgency (buy during the promotional period)

- Generates additional sales and profit

- Sells inventory that is not appealing to clients at its initial price

Cons:

- Extensive marketing efforts and expenses

- Clients may consider discounted products as low quality ones

- Encourages clients to wait for promotions and discounts

Who uses it?

Very often used by retailers who have seasonal products or products impacted by trends. Fashion, furniture, decor are niches that use this type of pricing.

Economy Pricing Strategy

Alternative name: no frill low price, budget pricing

What is economy pricing strategy?

This strategy is based on reducing production costs and marketing costs at maximum. The goal of this strategy is to attract the category of clients that is very sensitive to price. Because in such cases the costs are lowered, companies may practice lower prices and still be on profit.

Economy pricing is a volume based strategy and is mostly used during recession times or by hard discounters.

Pros:

- It’s easy and fast to implement

- Very useful for large companies that have brand awareness and can rely on sales volume

- Client acquisition costs are reasonably low

Cons:

- Requires a tight cost management and robust processes

- Relies on small margin

- Might not work properly for small business or those that are just starting

- Has no relation with the value provided

- Requires a constant flux of new customers

Who uses it?

It is used by a wide variety of companies, particularly discount retailers, food suppliers, generic medications, budget airlines, etc. Store brand products are the perfect exponents of this strategy.

Promotional Pricing Strategy

What is promotional pricing strategy?

It is a pricing strategy that involves the systematic price reduction of a product or service for a short period of time with the purpose of increasing sales and attracting new prospects and clients.

Promotional pricing examples:

- Black Friday

- Buy one product get two

- Save 30% off today

Promotional pricing campaigns are usually short-term marketing efforts.

Pros:

- Triggers and incentivizes clients to act immediately, on impulse

- Increases sales volume on short term and attracts new customers

- Creates excitement about a product

- Liquidation of outdated inventory

- May generate cross selling and upselling

Cons:

- May negatively impact price perception and clients’ loyalty

- Creates rapidly a constant expectation about receiving bargains

- Promotions accumulate very fast and become difficult to manage

- Generates confusion as customers come for the low price not for the product itself

- May jeopardize the relations with your competitors

Who uses it?

All types of businesses.

Psychological Pricing Strategy

What is psychological pricing strategy?

This strategy is used by businesses to increase sales based on customers’ emotional impulses and emotional reactions. As it creates the illusion of increased value.

It’s notorious that, in general, customers will buy a product priced 9,9€ quicker than one priced 10€ for the simple fact that it seems cheaper (“charm price”).

Other psychological pricing strategies are:

- Place a more expensive product near the one that you want to increase sales for (through comparison it will seem cheaper)

- Offers like “buy two get one for free” seem too good to be missed

- Modifying the color, size or font of the pricing information sometimes leads to increased sales

Pros:

- High return on investments

- Simplifies the purchase decision process for the client

- Offers proof of value (if everyone has the product, it has to be valuable)

Cons:

- The strategy is effective only when there is consistent demand for your product

- Clients may feel manipulated and skip on your offer

- May hurt your brand perception

- Does not guarantee sales increase

Who uses it?

Any business can use it and all of them make promotions at a certain moment.

Premium Pricing Strategy

Alternative name: luxury pricing, prestige pricing strategy

What is premium pricing strategy?

A premium pricing strategy is used by companies having unique products that no other company can copy or compete with. These products are presented as high value, premium or luxury. The fundament of this strategy is the perceived value of the respective product and not its real value or production cost.

Premium pricing is in direct connection with the brand awareness.

Pros:

- Elevates the brand awareness

- High profit margins

Cons:

- Hard work to build the perception of high value

- The marketing strategy and the whole business strategy should be in line with the prestige pricing strategy

- Once you use this pricing strategy you cannot use another one without losing your status

- Increased marketing expenses

- A limited number of clients

Who uses it?

The luxury industry, fashion companies, brands that market their products as exclusive, rare and luxurious. You can also use this strategy when you are launching a new product, or if just a limited quantity can be produced.

Bundle Pricing Strategy

What is bundle pricing strategy?

Bundle pricing includes two or more complimentary products/services sold together for one price (that is lower as if the products were bought individually). You can choose to also sell the products that compose the bundle separately as individual products.

Such an offer brings more value to clients paying upfront for more products.

Business owners should take into consideration that the profits obtained on higher value products should cover the losses of the lower value products.

Pros:

- Hooks customers on more than one product

- Increases revenues and customer loyalty

- Sells products that clients not necessarily need but buy them because of the bundle

- Efficient manner to reduce inventory

Cons:

- Choosing what products to bundle may be a complex process

- Increased marketing efforts

Who uses it?

Practically all types of businesses could use this type of price strategy at a certain point, but most often is used when a product’s lifecycle closes.

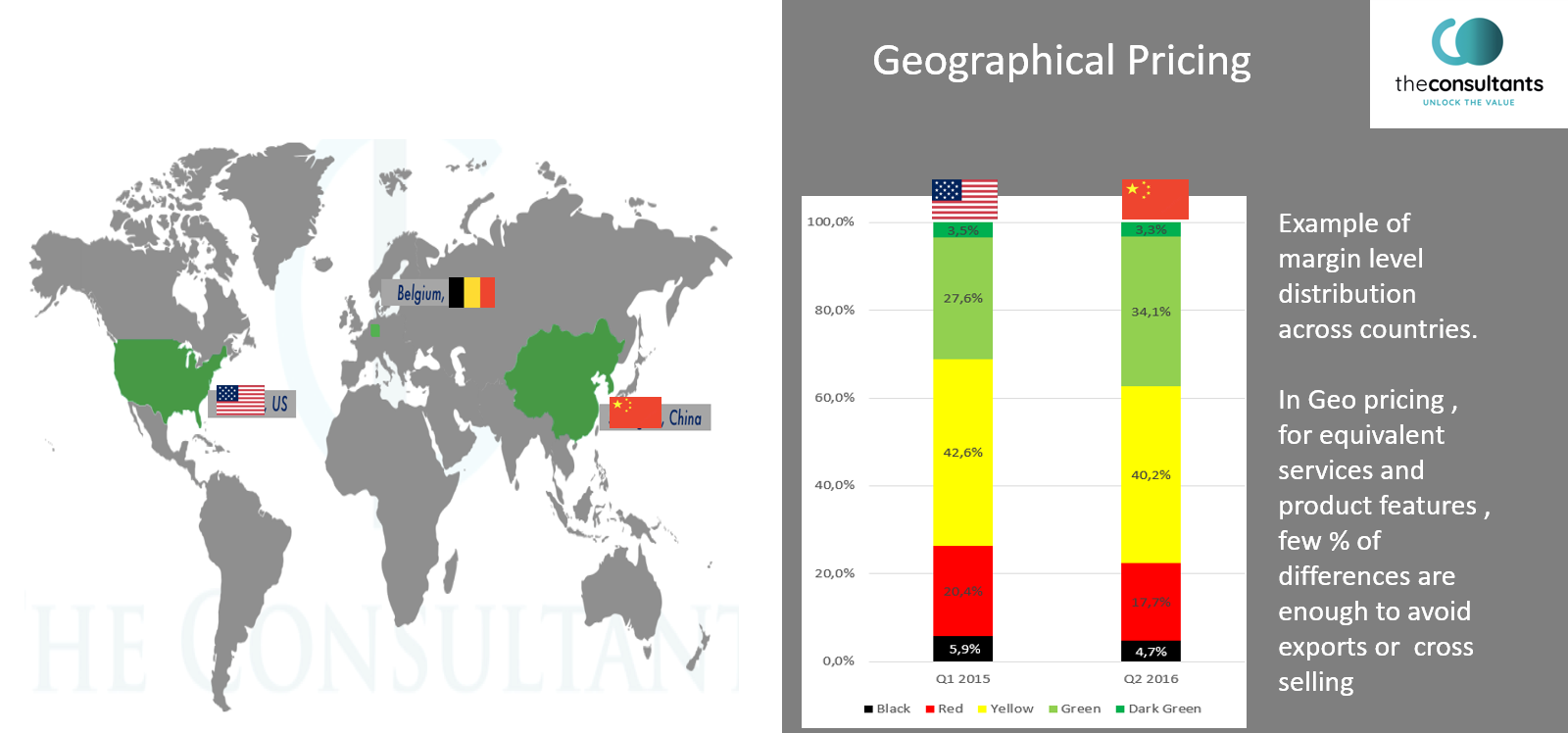

Geographic Pricing Strategy

What is a geographic pricing strategy?

Geographic pricing strategies are based on differentiating factors according to the place where the product and services are sold. It can rely on socio demographics, logistics or available alternative factors. International companies use it to differentiate their products/services in various regions of the world, to avoid cross border selling.

Factors that impact prices of a product in various regions are the status of the economy or wages of that region, local taxes, shipping costs, local expenses, currency conversion rates, local supply and demand, etc.

For example, if a product is imported in another country most probably it will be more expensive than in the country that produces it.

Pros:

- Increased revenues thanks to increased reach

- May obtain better prices in regions with higher lifestyle or where the offer is scarce

Cons:

- May discriminate buyers

- May become very complex

Who uses it?

International companies.

Hourly Pricing Strategy

Alternative name: rate-based pricing

What is hourly pricing strategy?

Hourly pricing strategy means to pay a specialist for his time. You literally trade time for money.

Pros:

- Easy to understand and apply

Cons:

- Some customers may reject this type of strategy as it pays for the labor not the value

- Time estimates may be difficult to assess

Who uses it?

Most often used by coaches, consultants, doctors, lawyers, freelancers, contractors or other suppliers that provide services.

Captive Product Pricing Strategy

Alternative name: two parts razor pricing

What is captive product pricing strategy?

This is a pricing strategy that involves a “main product” and other “complementary or accessory products”. The main product is used to attract the clients and the complementary to generate profits thanks to the repetitive sales. The captive products are the main products that are useless without the complementary ones. Examples of such products are coffee maker/coffee pods, games console/video games, printers/cartridges.

Pros:

- Increases sales and profit margins

- Attracts many clients as the main product is at low price point

- Repetitive revenue

- Strengthens customers’ loyalty

Cons:

- Customers’ negative feeling might be a roadblock for the success of this strategy

- Heavy investments and continuous efforts to offer a large variety of options to please customers’ demand

Who uses it?

Companies that market products lines and have products or services allowing such a model.

Tender Rounds Pricing Strategy

What is tender rounds pricing strategy?

It is a pricing strategy used for complex projects that imply long contracts and several rounds of bids. Used for complex products and service agreements.

Pros:

- Selects the best possible provider

- Obtains eventually the best report price-quality

Cons:

- Lengthy and resources consuming process

Who uses it?

Large companies, state authorities who manage large projects of public interest.

Pricing Strategies Examples

Companies do not use a stand alone pricing strategy, most often they use a mix of pricing strategies that changes over time.

Here are some pricing strategies examples to see them in action:

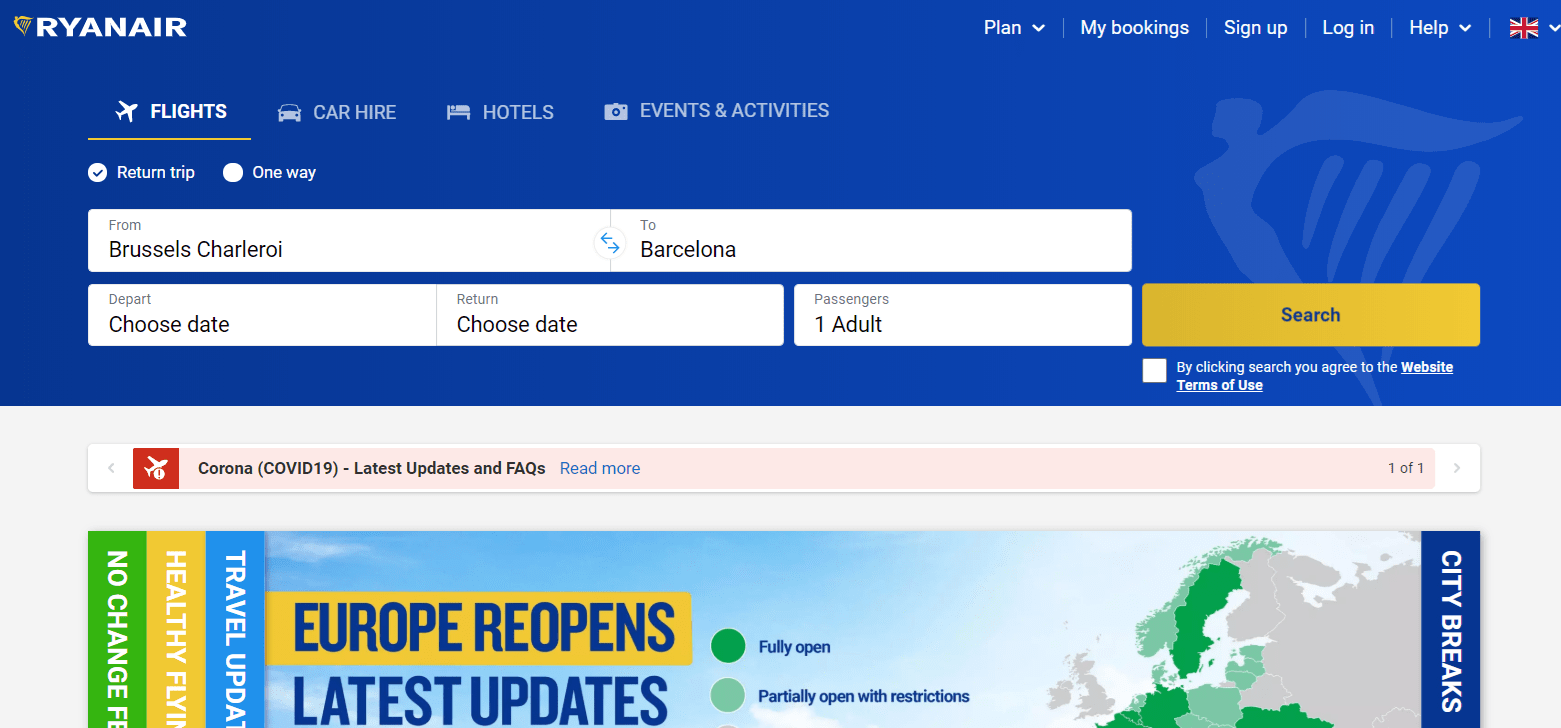

Dynamic Pricing Strategy: RyanAir

Source: RyanAir

Airlines most of the time use dynamic pricing and RyanAir is not an exception. We all noticed that during holidays like Christmas, New Year’s Eve, Easter the price of flight tickets increases. If you buy a ticket for a flight with six months in advance most often it will be cheaper than if you buy it one month in advance. If you buy a ticket for a flight scheduled for tomorrow there are huge chances to pay triple or quadruple for it, than if you would have bought it earlier.

Plus, if you search several times for a certain flight, when you finally decide to buy you will notice that your final price is slightly higher.

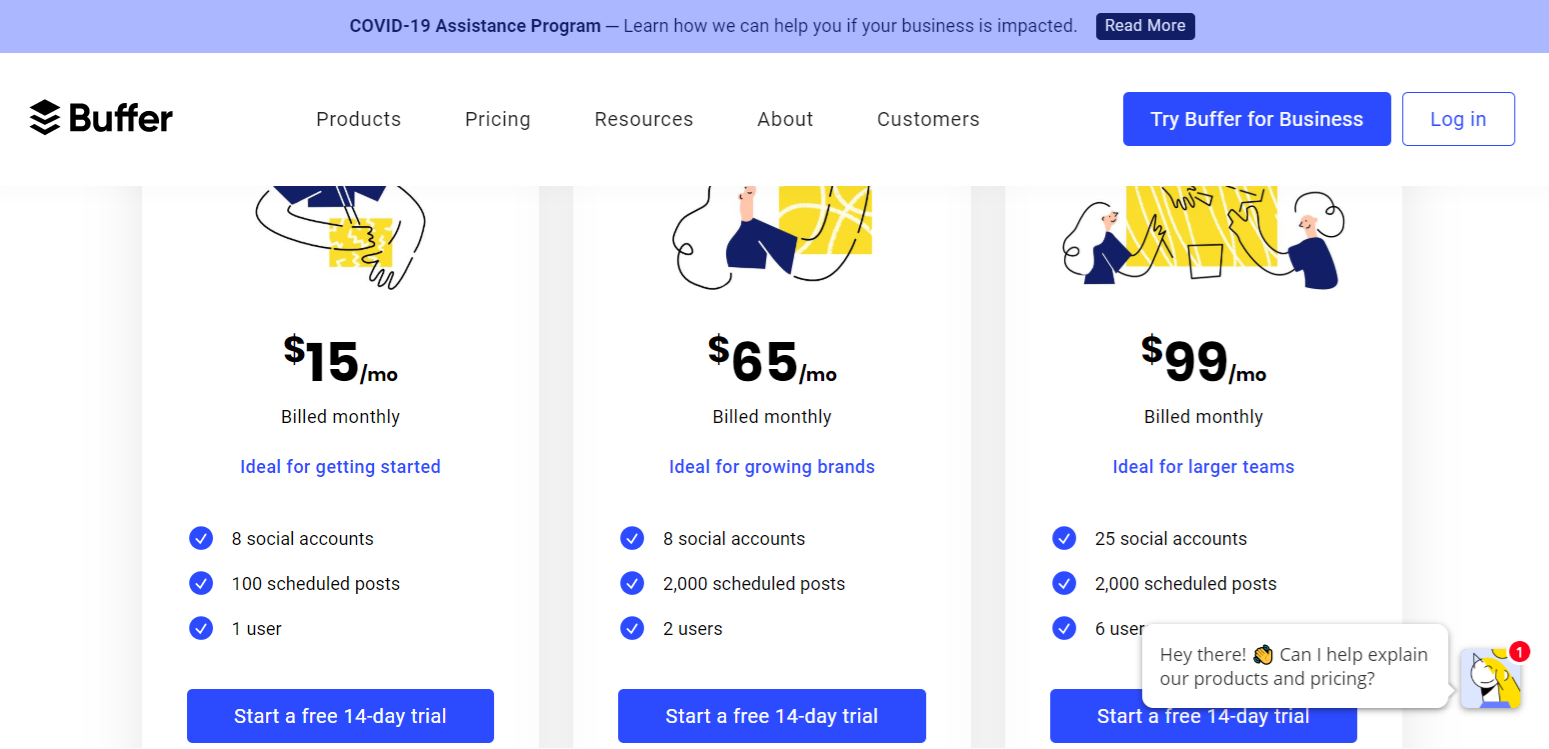

Freemium Pricing Strategy: Buffer

Source: Buffer

Buffer is a social media management tool that allows you to schedule content for all your social media channels in one dashboard. They offer a 14 days free trial to get a glimpse of their services and after that if you want to use the service you have to pay.

Skimming Pricing Strategy: Apple’s iPhone

Source: Apple

Apple has used brilliantly the skimming pricing strategy for its iPhone – when a new version is launched has the highest price and it decreases as the time passes and new updated versions appear.

They even have programs to encourage clients to upgrade to the new version of iPhone each time a new one is released like “iPhone Upgrade Program” and “Apple Trade In”.

The above examples look quite simple and somewhat obvious. But deciding on the pricing strategy inside an organisation is far from being a simple process. Not to mention changing strategies and migrating from one strategy to another. Particularly for international companies that sell their products in multiple countries through multiple channels.

How does a large company migrate in reality from a cost plus based pricing strategy to a value based pricing strategy?

Well, that’s a complex process.

Here is an example that shows how an international company was able to switch to the value based pricing strategy via a design thinking approach.

But first let’s clarify what is design thinking.

Design thinking is a creative and iterative process that aims to solve businesses, processes and new products problems via a holistic approach based on a better understanding of the user and context. Design thinking usually identifies alternative strategies and solutions that are not obvious at first sight. It is a collection of methods and simultaneously a way of thinking.

Design thinking focuses on understanding the customer for which the products and services are created.

Company overview and problem

A mid size multinational company, that sells products in 30 countries, in a business to business market, wants to shift their pricing strategy from cost based to value based.

The problem is that the company needs to have a comprehensive understanding of their customers’ needs and the value perception of their products. This is a prerequisite for the value based pricing strategy.

For the moment, the company uses ad hoc methods to understand their customer needs and applies the findings in the pricing process. But these ad hoc methods translate into time consuming and inconsistent decision making, and consequently into significant differences between the company’s offer and the customers’ desires.

A concrete situation: product K was launched as a medium level alternative to a premium product. The product, having over 5,000 Stock Keeping Units (SKU) in portfolio, was supposed to be sold in 10 countries, having a different buying power and economic situation then current customers. Plus, one price point was proposed. And price deviation demands were treated in an ad hoc manner, with short term solutions in function of the decision makers availability and current operations.

Use of design thinking to solve pricing transformation

Practically the fundamentals of design thinking are employed to design the value-based pricing.

The first step imposed that the top managers in charge with solving the pricing related issues understand which are the problems encountered by the parties implicated in the pricing process. The parties implicated are: country sales managers, marketing managers, the chief financial officer and the chief operations officer. Top managers interviewed the aforementioned parties.

The output of these interviews was analysed with the help of an affinity diagram and a value based pricing strategy was created.

Findings resulting from interviews:

- Disconnection between the sales and product management teams as sometimes they did not agree on aspects like: market needs, product features, achievable targets in terms of profit.

- A lengthy interval was needed for the leads to take action after receiving market feedback, from 5 days to 6 months.

Proposed design of value based pricing process

The purpose was to come up with an active iterative pricing process. The main elements used for it were: systems thinking, empathy and codesign. In practice, it means that numerous employees from various departments recover and validate customer reactions and market feedback in a seamless manner. To make the process iterative, informal and continuous interactions take place among sales and customers/distributors.

Product management and pricing management teams are in charge with processing the market feedback. The information flow is simple and includes 6 parties: sales employees, product managers, suppliers, distributors, focus groups and social media. A common base, containing answers related to the company’s products and customers’ expectations was created for sales and product management. And a direct channel of communication was settled between the latter and the information sources. Plus, sales and management teams discuss based on the same information that they validated in common.

Escalation to the top management takes place only for the cases that really need to.

Benefits of the approach:

- Identification of the major cause of price deviation, retrieving the information from the correct source becomes feasible

- Reduction of the decision lead time between marketing and sales

- The new solution removed the complexity of the decision making and helped stakeholders concentrate on their responsibilities

- Understanding which are the essential elements of the product for which the clients are willing to pay, helped the company to modify the products in this direction and price them adequately to maintain the market share.

Take Away

Choosing the right pricing strategy for your business, in the right moment is paramount. And you need to take into consideration a plethora of details and data in order to determine the best option. You can do it on your own by starting to study the strategies listed above or you could hire an expert.

Key Contact

Baydhir Badjoko, CEO The Consultants bvba

+ 32 3 297 55 78 | badjoko@theconsultants.eu

https://www.linkedin.com/in/theconsultants/

If you are ready to take the steps for better pricing, we are one click away. Call The Consultants or send us a message – info@theconsultants.eu